Related articles

ASST Stock Price Prediction 2025 — A Beginner’s Guide2025-10-31 16:32:17The ASST stock has recently gained significant attentio […]

Best Bitcoin Casinos for November 2025 — Safest Picks, Fast Withdrawals & Beginner’s Tutorial2025-10-31 14:51:26The global online gambling market surpassed $97 billion […]

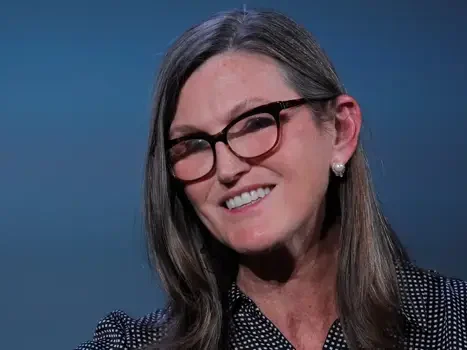

Cathie Wood Robinhood Crypto Investment – What It Means for Crypto Investors2025-10-31 10:34:32When seasoned investor Cathie Wood and her firm ARK Inv […]

Nvidia Stock Price Prediction 2030 — Can NVDA Reach $9 Trillion Market Cap?2025-10-31 09:03:17Nvidia, though, has already started breaking records in […]

Kolscan vs Other Memecoin Analytics Tokens: Which One Has the Best Price Potential?2025-10-30 18:13:12Traders who want to locate and follow successful wallet […]